@snood,

Please explain.

izzy's proof is that he simply said "Most of your rich people inherited it"

I provided a few links with statistics and data.

Maybe the first source wasn't that great, but Forbes and US News are fine sources.

Do you want me to find more data?

While it is obviously true that big players, billionaires can leave a lot to their heirs, it is just as obvious they are a small percentage of the population.

Actually, I like this link below because charts and graphs.

https://www.financialsamurai.com/the-average-net-worth-by-age-for-the-upper-middle-class/

This data came from the US Federal Reserve, which you can't access directly (I tried by going through the link. You have to join) .

I'm going to say I trust their data.

Of course one can jump all over this and say "Well, that just applies to White people", but that doesn't change one bit the actual distribution, which includes Everyone.

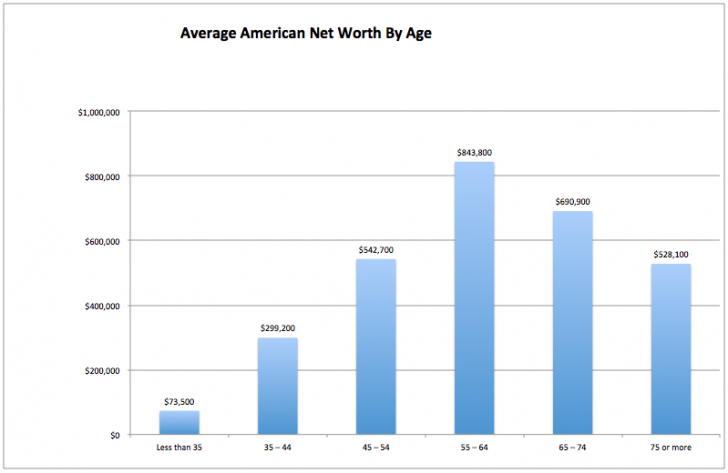

So the Average person, overall, if they die from age 65 to over 75, has an average net worth of between about 5 and 7 hundred thousand dollars. That's a nice chunk of money. But if you have 2 or more heirs, it's not like you're leaving them this "enormous inherited wealth" .

Plus, if you look at the ages...

Someone dies between 65 and 75 plus.

They are most likely leaving it to sons and daughters. Who are aged 45 to 55.

Take a look at the chart and you'll quickly see the big jump between the 45-54 and 55-64 groups. A rise of almost exactly $300k. Which is pretty much half of what people 65 and up are worth.

Kinda like someone is leaving their stuff (at that point probably mostly a house) to a couple of adult children. Adult children who will sell the house and split the gains.

My issue isn't that most wealth in total isn't being left to heirs, but the blatantly ridiculous idea that most People who end up being what is considered wealthy at this moment through inheritance.

Most people, if they acquire wealth, do so through work (whether employed or owning a business), and taking that money and wisely investing it, holding onto capital gains, and living basically modest lives.

They acquire money and wealth through compound interest, reinvesting divdends into their stock portfolio, and own real estate. They get up to middle age and if they were fortunate enough to have parents who were the same way, are left a nice, but modest amount, which is a nice cherry on the top.

Then they retire, just as their parents did, living nicely on what they acquired over 40 years of work, and repeat the cycle with their adult children.

Honestly?

If a person who is poor, and it has been a generational thing for a long time, this is maybe incomprehensible.

I can't help that.

If there was and is one thing I have always wanted to do in my life, it would be to have touched more lives than I have with coaching them in how small things, small changes can make big differences. Not for them maybe, but for their children who are young enough.

I was listening the other day about a program (don't remember the years) where poor families were given the opportunity to move from really poor neighborhoods to solidly middle or upper middle class one.

The results (basically) was that beyond having better housing, living in a lower crime area etc., there was no effect on the savings/wealth accumulation of the parents. They remained poor in the middle of relative affluence.

Ditto with their children who were already over a certain age when they moved. They went on to returning to poverty when they went on their own, even though they had several years of better education.

The payoff was in their younger than a certain age children, and children that were born after the move.

They overall became solidly middle or upper middle class.

BTW, what is really personally interesting to me is that looking back, and looking forward from the age I am right now, I am precisely, eerily where this chart shows, and where I expect to be. And for precisely for the reasons I talked about above.

Worked and invested, managed (and I do not meant this sarcastically) to not get arrested, modest inheritence in 50's, continued to work and invest, lived modestly, and now can relax the reins a bit.

Yes I'm white. I'm sorry about that. Again, not totally meaning that sarcastically. I feel a lot of the time I don't get the freedom to actually say the really boring thing, without making apologies of "I'm white, managed not to get arrested at any point, although I certainly deserved it, just never got caught, worked, lived boring modest life, and ended up comfortable."

It's just not much of a story. But one over the years I've been told in one way or another I need to apologize for. But, I've paid my dues.

Related to this, that idea of "I want things better for my children" It's like a mantra.

So you educate and raise your kids. When they become middle aged you die and leave them what you can because you want things better for them.

Then, it becomes, "Oh, you're just leaving your wealth to your heirs, and that's why they're wealthy. Just like most people get their wealth"

Yeah, like your two or three 50 plus year old children are just gonna go nuts with their lives with the 2 to 4 hundred thousand divided amongst them though the gain through selling your house. Whoo whee! Break out the cream puffs and pink champagne!

Bottom line, if you think about it for more than a moment is, most people who end up wealthy simply did not become weathly through inheritence. Period.