Cycloptichorn wrote:Foxfyre wrote:So if you're concerned, lobby your elected representatives to spend more. They are the ones with the power to do so, not the President. And if they don't, just how concerned for the poor do you really think they are? Or perhaps my take on it that it is all purely partisan political hype is the right one.

It wouldn't bother me if the funding was cut so much if there weren't also massive tax breaks proposed in the same budget. Doesn't make any sense to be giving tax breaks during a time when services are pared back.

Cycloptichorn

Why doesn't it make sense? You cut taxes, you cut spending. Whether that's a good thing or not will depend on your preferred size of government and your preferred distribution of income. But cutting taxes along with spending seems like a consistent policy to pursue. How doesn't it make sense?

Thomas wrote:Cycloptichorn wrote:Foxfyre wrote:So if you're concerned, lobby your elected representatives to spend more. They are the ones with the power to do so, not the President. And if they don't, just how concerned for the poor do you really think they are? Or perhaps my take on it that it is all purely partisan political hype is the right one.

It wouldn't bother me if the funding was cut so much if there weren't also massive tax breaks proposed in the same budget. Doesn't make any sense to be giving tax breaks during a time when services are pared back.

Cycloptichorn

Why doesn't it make sense? You cut taxes, you cut spending. Whether that's a good thing or not will depend on your preferred size of government and your preferred distribution of income. But cutting taxes along with spending seems like a consistent policy to pursue. How doesn't it make sense?

Overall spending has not been reduced in correlation with the tax cuts.

Yet federal income is higher with the tax cuts. odd.

McGentrix wrote:Yet federal income is higher with the tax cuts. odd.

Federal income increased during the Clinton years without tax cuts.....odd.

The increase during the Clinton years began with the Reagan tax cuts of several years earlier. Hardly odd at all.

Thomas wrote:Cycloptichorn wrote:Foxfyre wrote:So if you're concerned, lobby your elected representatives to spend more. They are the ones with the power to do so, not the President. And if they don't, just how concerned for the poor do you really think they are? Or perhaps my take on it that it is all purely partisan political hype is the right one.

It wouldn't bother me if the funding was cut so much if there weren't also massive tax breaks proposed in the same budget. Doesn't make any sense to be giving tax breaks during a time when services are pared back.

Cycloptichorn

Why doesn't it make sense? You cut taxes, you cut spending. Whether that's a good thing or not will depend on your preferred size of government and your preferred distribution of income. But cutting taxes along with spending seems like a consistent policy to pursue. How doesn't it make sense?

It doesn't make sense b/c the spending cuts hurt members of our society - and this has actual evidence - whereas the tax cuts show no evidence whatsoever of helping society in any way.

I understand that many Republicans never met a spending cut they didn't like, but I don't subscribe to that particular brand of lunacy.

Cycloptichorn

georgeob1 wrote:The increase during the Clinton years began with the Reagan tax cuts of several years earlier. Hardly odd at all.

Sorry, the increases didn't go up under Reagan until after he

raised taxes - several times.

Cycloptichorn

Borrowed from another thread on a2k:

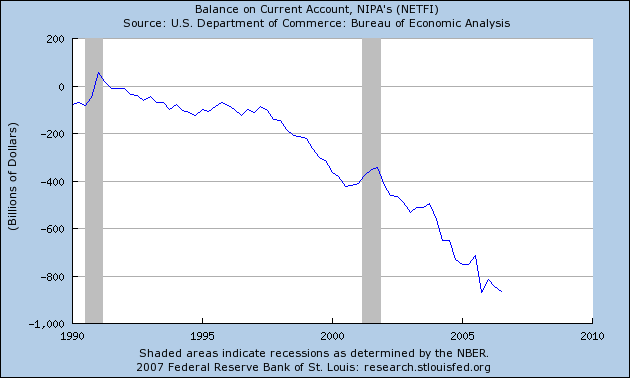

Because we have no national savings:

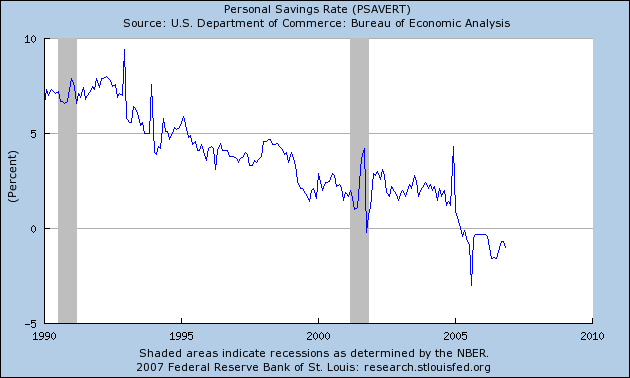

Foreigners have increased their share of US debt holdings:

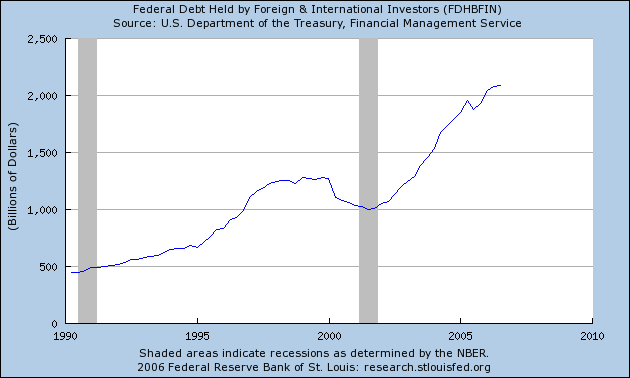

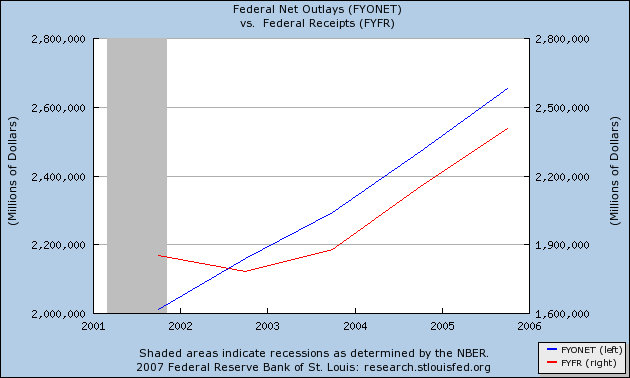

The federal budget deficit is nowhere near under control (on the chart, notice the receipts scale is lower than the expenditures scale).

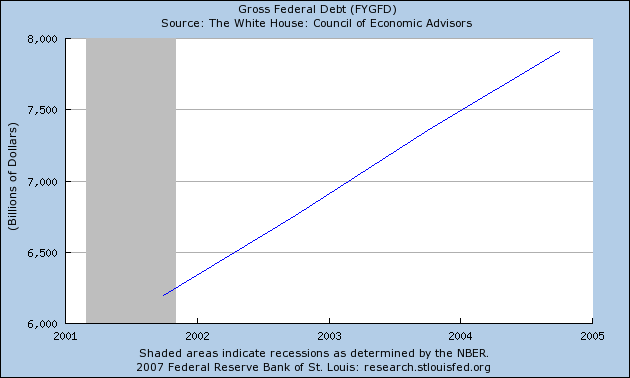

This increases US Gross Federal Debt at a strong and steady rate:

(NOte that the above graph only goes to '05. You don't even want to think about where that number is here in '07.)

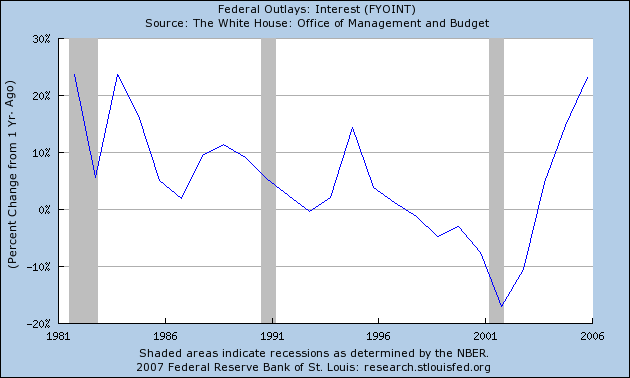

The amount of interest we have to pay on our debt is increasing. Here is a chart of the year-over-year change in the amount of interest we have to pay:

Thanks CI.

This is what you are seeing in our modern economy - an expansionary period which has been fueled by loans and speculation, and absolutely nothing else.

Cycloptichorn

Most people who continue to tell us that our economy is doing fine just doesn't understand economics. Uncontrolled debt by both the government and consumers bodes badly for the future of our economy - no matter which side of party politics one is on.

When borrowings continue to outstrip productive capacity, our money is going to lose its value, because there's nothing to back it up. The only benefit the US will see is that all that money owed to other countries and holders of US currency will become cheaper, and our balance of trade will benefit.

Here is a telling piece that exposes the weaknesses of Reaganomics.

--------------------------------------------------------------------------------

Lower Deficit Sparks Debate Over Tax Cuts' Role

By Lori Montgomery

Washington Post Staff Writer

Tuesday, October 17, 2006; Page D01

With great fanfare, President Bush last week claimed credit for a striking reversal of fortune: New figures show the federal budget deficit shrinking by 40 percent over the past two years, a turnaround the president hopes will strengthen his push for further tax cuts.

Bush hailed the dwindling deficit as a direct result of "pro-growth economic policies," particularly huge tax cuts enacted during his first term. "Tax relief fuels economic growth. And growth -- when the economy grows, more tax revenues come to Washington. And that's what's happened," Bush said.

Who's Blogging?

Read what bloggers are saying about this article.

fineline

Beat the Press

macroblog

Full List of Blogs (34 links) »

Most Blogged About Articles

On washingtonpost.com | On the web

Save & Share Article What's This?

DiggGoogle

del.icio.usYahoo!

Reddit

Economists said Bush was claiming credit where little is due. The economy has grown and tax receipts have risen at historic rates over the past two years, but the Bush tax cuts played a small role in that process, they said, and cost the Treasury more in lost taxes than it gained from the resulting economic stimulus.

"Federal revenue is lower today than it would have been without the tax cuts. There's really no dispute among economists about that," said Alan D. Viard, a former Bush White House economist now at the nonpartisan American Enterprise Institute. "It's logically possible" that a tax cut could spur sufficient economic growth to pay for itself, Viard said. "But there's no evidence that these tax cuts would come anywhere close to that."

Economists at the nonpartisan Congressional Budget Office and in the Treasury Department have reached the same conclusion. An analysis of Treasury data prepared last month by the Congressional Research Service estimates that economic growth fueled by the cuts is likely to generate revenue worth about 7 percent of the total cost of the cuts, a broad package of rate reductions and tax credits that has returned an estimated $1.1 trillion to taxpayers since 2001.

Robert Carroll, deputy assistant Treasury secretary for tax analysis, said neither the president nor anyone else in the administration is claiming that tax cuts alone produced the unexpected surge in revenue. "As a matter of principle, we do not think tax cuts pay for themselves," Carroll said.

But, he said, "we do think good tax policy can lead to important economic benefits. . . . The size of the tax base is larger than it would have been without the tax relief."

The subtleties of that argument have been lost on the campaign trail. With less than three weeks to go until the Nov. 7 election, Republicans are promoting the good fiscal news, eager to talk about something other than the House page scandal and mounting casualties in Iraq.

House Speaker J. Dennis Hastert (R-Ill.) claimed credit for "driving down the deficit" and accused Democrats of plotting to roll back the tax cuts if they win a majority in the House, a move Hastert said "would destroy jobs and hurt the economy." Bush, meanwhile, called on Congress to permanently extend the cuts, which are scheduled to expire by 2010, at an additional cost to the Treasury of $2.2 trillion by 2016, according to CBO estimates.

Democrats criticized the president for celebrating a deficit that still ranks among "the largest in our nation's history," as House Minority Leader Nancy Pelosi of California put it. And they pointed to CBO projections that the deficit will rise again next year and balloon in coming decades as 78 million retiring baby boomers make claims on Social Security and Medicare.

"The truth is that the administration's fiscal policies have failed," said Sen. Kent Conrad (N.D.), the senior Democrat on the Senate Budget Committee. "They have not benefited most Americans. They have dramatically worsened our long-term budget outlook. And they are putting our fundamental economic security at risk."

Without question, the deficit is receding. Despite spending swollen by storm cleanup on the Gulf Coast and the war in Iraq, the deficit fell to $248 billion in the fiscal year that ended Sept. 30, down from a record $413 billion in 2004, as higher tax receipts poured into the government's coffers.

Our major portion of our economy is based on retail sales. When most consumers have higher and higher debt loads, retail sales will suffer - for the long term. That means sales will drop, employment in the retail industry will drop, and tax receipts will drop.

The only good news is the simple fact that competition will increase - which will result in lower prices for the consumer.

It's almost like there is a different

thread in which you could discuss this and leave the Bush supporters thread for what it's purpose is... almost.

McG, without us you have a chatroom, exchanging stupid platitudes. Is that what you want?

McG, Our economy is "directly" related to Bush. It supports Bush's incompettence and mismanagement of almost everything he touches, and that includes our economy.

BTW, Have you benefited from Bush's tax cuts, because he claimed our economy will benefit from "more investments?"

cicerone imposter wrote:McG, Our economy is "directly" related to Bush. It supports Bush's incompettence and mismanagement of almost everything he touches, and that includes our economy.

Then why do we have different threads c.i.? Why not just one big one where people chat about whatever they feel like?

Cycloptichorn wrote: It doesn't make sense b/c the spending cuts hurt members of our society - and this has actual evidence - whereas the tax cuts show no evidence whatsoever of helping society in any way.

Assuming that taxes are cut by the same amount as spending, the redistribution will always hurt some members of society and benefit other members of society -- by the same dollar amount. That's why I said: whether you like the whole thing or not will depend on your preferred distribution of income. But "my preferred distribution of income looks different" isn't the same as "it doesn't make sense." And when you diagnose your political opponents with mental conditions, it will only make people question your own conception of "sense", not your opponents'.

Maporsche's objection is apt though: taxes and spending weren't cut by the same amount.

McGentrix wrote:leave the Bush supporters thread for what it's purpose is...

aftermath

you've definitely got folks experiencing that

McG, I'm surprised you still haven't caught on to the ways of a2k after all these years. Most threads with a title allows for a broad array of opinions on the subject. With so many threads with related subjects, it's not uncommon to participate in more than one with similar subjects.