@DrewDad,

The graphs were collected from the US treasury site.

reference:

http://www.treasurydirect.gov/NP/BPDLogin?application=np

There are two concepts that need to be mentioned which go into what makes up the national debt. The public debt and the intergovernmental holdings. The public debt is made up of things like savings bonds, treasury bills and anything else the public can purchase from the government.

The Intragovernmental holdings is when the government borrows money from itself, usually from social security (which is why it is bankrupt). But not always just this form. Recently the US has been buying it's own treasury bills, basically selling debt to itself and then buying it back. A crime in itself but no one calls them on it.

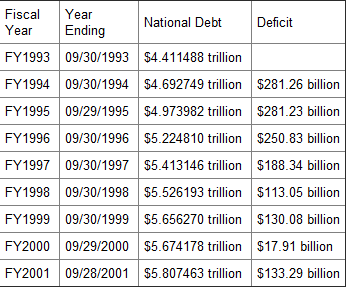

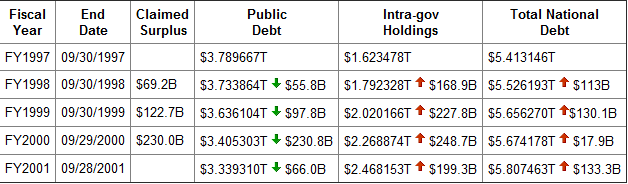

So the claimed surpluses for the last four fiscal years under clinton are as follows:

You can see when the public debt went down in each of those four years the intragovernmental holdings went up each year by a larger amount. The national debt which is the public debt plus the intragovernmental holdings, went up. Here is the discrepancy.

So the claim is that under clinton he paid down the national debt which is completely false as you can see the national debt went up every single year. What clinton did was paid down the public debt but claimed surplus is close to the decrease in the public debt for those years. But he paid down the public debt by borrowing the money from the intragovernmental holdings which at the time was mostly in the form of social security.

Here is a quote from an article at CBS at the time the claims were being made.

Quote:Over the past 25 years, the government has gotten used to the fact that Social Security is providing free money to make the rest of the deficit look smaller," said Andrew Biggs, a resident scholar at the American Enterprise Institute.

The thing is it might not have been directly thought out plan by clintion because the social security administration was legally required to take all surplus and buy US government securities and then sell those securities which then becomes intragovernmental holdings.

The economy was doing well at that time because of the dot com bubble and people were earning a lot of money and thus paying a lot of money into social security. Since social security had more money coming in than what it was paying out all the "extra" surplus social security funds there was no need for the government to borrow more money directly from the public. So the public debt went down while the intragovernmental holdings continued to sky rocket.

So what resulted? The national debt most definiately did not get paid down because we did not have a surplus and the government covered it's deficit by borrowing money from social security rather than the public.