People who blow up women, children, mosques, or whatever they can are terrorists no matter what their country of origin.

...Japan.

T

K

O

I have no delusion about Bagdad ever looking like SD.

[QUOTE='foxfyre"]I'm guessing that a pretty substantial majority of Americans would like to see the victim pulled to safety and would like to see us leave Iraq with honor knowing that we were successful and left it a much better place than it was.

Obama wants to rebuild the military as it was under FDR, Truman, and JFK, so maybe we can see some more big ones in the future, Diest?

revel wrote:Quote:Are you of the opinion that all the Iraqis are part of the warring factions? I think the evidence would show that the militants (mostly terrorist groups) are creating 99% of the problems but constitute a very small percentage of the general population.

Foreign terrorist only make up 10%; the rest are Iraqis who are fighting over power.

Quote:Foreign militants make up only a small percentage of the insurgents fighting in Iraq, as little as 10 percent, according to US military and intelligence officials.

source

As for the militias, every party in Iraq has them including Maliki and the Kurds. Sometimes the militias are only ones providing services and security from other tribes militias. They are in fact supported by the population of the people they represent.

Iraq as a Militia War

So why not let them fight it out and settle into their own communities so to speak?

People who blow up women, children, mosques, or whatever they can are terrorists no matter what their country of origin.

okie wrote:Obama wants to rebuild the military as it was under FDR, Truman, and JFK, so maybe we can see some more big ones in the future, Diest?

You are a mighty sick individual.

To TKO, if you don't understand the analogy of the rope or how it is applicable, I doubt there is anything I can do to help you understand that.

To Revel, I am guessing that in 100% or at least nearly 100% of those polls, the questions were posed as you probably would have posed them. I am also guessing that given a choice between leaving Iraq with honor knowing that a success was accomplished, that terroism was struck a significant, possibly fatal blow and a choice of turning it over to terrorist despots and thus encouraging and strengthening terrorism, you would see much different responses.

And yes, the conservative point of view is that ANYBODY who intentionally blows up innocent men, women, and children is a terrorist no matter what other label they attach to themselves.

I am also guessing that there are some who so hate President Bush or anything that isn't their own particular ideology, that they would actually turn loose of the rope. I am glad that I don't believe that most Americans are that way, however.

President Bush continues to urge that the tax cuts enacted in 2001 and 2003 be made permanent. Despite the severe long-term budget shortfalls the nation faces, the Administration has not proposed measures to offset the cost of extending these tax cuts. Nor has it proposed measures to pay for extending relief from the Alternative Minimum Tax, which, if left unchanged, will affect increasing numbers of middle-income taxpayers and take back a substantial portion of the value of the 2001 and 2003 tax cuts (see the box below).

Making permanent the 2001 and 2003 tax cuts and AMT relief would have a direct cost of $3.7 trillion over the next ten years (fiscal year 2009 through 2018), according to Joint Committee on Taxation and

Congressional Budget Office estimates.

Without offsets, making the tax cuts permanent would increase the deficit and thereby add to the national debt. The interest payments needed to service this higher level of debt would amount to about $700 billion over the next ten years. Thus, the total cost of making these tax cuts permanent, including the related interest costs, would be $4.4 trillion over the ten-year period (see the appendix).

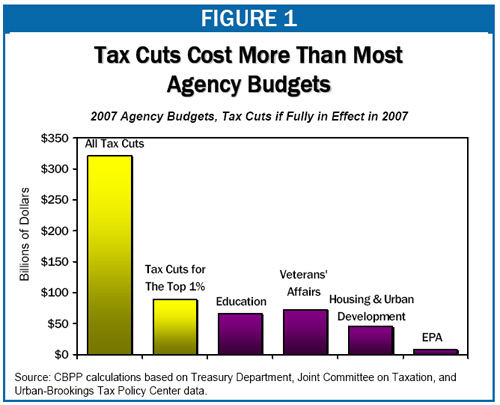

Once the tax cuts are fully in effect, their annual cost (not including debt service) will amount to about $400 billion per year. In 2007 terms, that amount is about eight times what the federal government spent last year on K-12 and vocational education and about ten times what it spent on hospital and medical care for veterans.

In today's terms, that amount also exceeds the combined 2007 budgets of the Departments of Education, Homeland Security, Housing and Urban Development, Veterans' Affairs, State, Energy, and the Environmental Protection Agency (see Figure 1).

When the tax cuts are fully in effect, the cost of tax cuts for just the highest-income 1 percent of households (those with incomes above $450,000 per year) will be larger, in today's terms, than the entire budget of the Department of Education. This cost is so high because by 2010, the first year in which all provisions of the 2001 and 2003 tax cuts will be fully in effect, households in the top 1 percent of the income spectrum will receive tax cuts averaging more than $60,000 apiece. (Households with annual incomes above $1 million will receive tax cuts averaging more than $150,000.)

The costs of extending the tax cuts would be piled on top of the cost of already enacted tax cuts:

Through fiscal year 2007, tax legislation enacted since 2001 has had a direct cost of $1.3 trillion, according to Joint Committee on Taxation and CBO estimates. Another $900 billion in direct costs will be incurred by 2018, even if the tax cuts expire as scheduled (and excluding the cost of the recently enacted stimulus legislation).

Because these tax cuts were not paid for, they are also generating substantial increases in the national debt. The additional debt now being built up will persist even if the tax cuts are allowed to expire on schedule. As a consequence, the interest payments that must be made each year on the added debt will continue indefinitely, even if the tax cuts are not extended.

With these interest costs included, the cost of the already enacted tax cuts will be $3.9 trillion through 2018. As noted, the cost of extending the 2001 and 2003 tax cuts and providing AMT relief will total $4.4 trillion through 2018. Thus, the total cost will come to about $8.4 trillion for the period from 2001-2018; some $6.6 trillion of this cost will occur over the coming decade, 2009-2018. (See the appendix for a detailed table.)

The Tax Cuts' Impact on the Medium- and Long-Term Fiscal Outlook

In fiscal year 2007, the cost of tax legislation enacted since 2001, including interest costs, amounted to $300 billion. The fiscal year 2007 budget deficit totaled $162 billion. Thus, while the President now seeks to balance the budget in 2012, the budget would have been balanced already had tax legislation passed since 2001 not been enacted or been fully paid for.

Why We Include the Cost of AMT Relief in Our Estimates

The President's fiscal year 2009 budget calls for extending relief from the Alternative Minimum Tax for only one year, 2008.* Including the cost of a permanent AMT fix, however, gives a much better estimate of the true cost of the President's proposed tax policies. If AMT relief is not extended, a substantial share of the value of the 2001 and 2003 tax cuts - which the President wants to make permanent �- will be taken back by the AMT.

This would occur because taxpayers owe the Alternative Minimum Tax whenever their tax liability, as calculated under the AMT, is higher than their tax liability under the regular income tax. The 2001 and 2003 tax cuts sharply reduced households' tax liability under the regular income tax, without changing the structure of the AMT. As a result, with the tax cuts in place, AMT liability exceeds regular income tax liability for millions of additional households. These households then owe tax based on their AMT and not their regular income-tax liability, and hence do not benefit in full from the tax cuts.

According to the Urban Institute-Brookings Institution Tax Policy Center, the AMT will take back almost a third of the President's tax cuts by 2012. When the President urges that his tax cuts be made permanent, he presumably does not mean only the two thirds of the tax cuts that would remain if the AMT were left unchanged.

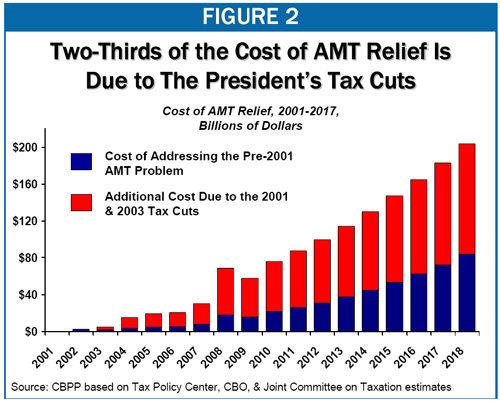

Indeed, much of the cost of AMT relief reflects the cost of providing taxpayers with the full value of the President's tax cuts (see Figure 2). The cost of providing AMT relief from 2001 through 2018, assuming that the tax cuts are extended, will be almost three times what it would have cost to provide relief from the growth in the AMT that would have occurred in the absence of the tax cuts.*

In this analysis, we provide estimates of the full cost of extending the 2001 and 2003 tax cuts and AMT relief through 2018. This is what it would cost the nation to extend the President's tax cuts and provide the AMT relief required to ensure those tax cuts would not be cancelled out in significant part by the AMT. Of the $4.4 trillion cost (including interest), about $500 billion reflects the cost of addressing the AMT problem that existed prior to 2001 (that is, the AMT problem that would still have existed had the 2001 and 2003 tax cuts not been enacted). The remaining $3.9 trillion reflects the cost of the President's tax policies.

Extending the Tax Cuts Would Significantly Worsen the Long-Term Fiscal Outlook

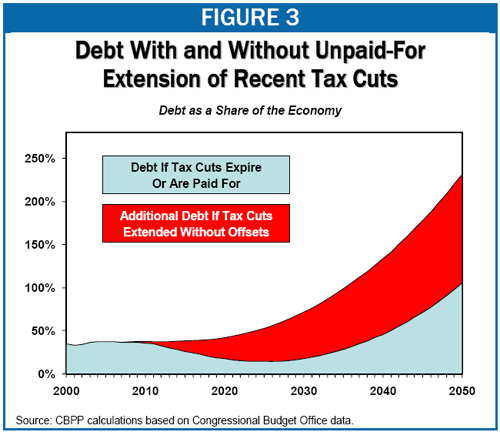

CBPP projections (which are based on Congressional Budget Office data) show the outlook for the federal budget under current policies is bleak, even if the tax cuts expire or are fully offset.[1] Under those circumstances, the national debt would reach 105 percent of GDP by 2050.

But extending the tax cuts enacted since 2001 without paying for them would sharply worsen this already very troubling long-term fiscal outlook. The tax cuts reduce revenues by about 2 percent of GDP each year. In addition, each year of extending the tax cuts without paying for them would add to the national debt and therefore to interest payments. As a result of the compounding effects over time, extending the tax cuts without paying for them would essentially double the size of the debt in 2050 (see Figure 3).[2]

Thus, the tax policy decisions that Congress will make over the next few years will have a profound impact on the nation's fiscal future. While putting the nation on a sustainable fiscal path will be very difficult in any case, it will be far more difficult if the tax cuts are made permanent without offsets.

The Tax Cuts' Impact on the Economy

The President and members of the Administration routinely argue that the tax cuts should be made permanent for the sake of the economy. This argument does not withstand scrutiny.

Extending Other Expiring Tax Provisions Would Add to Costs

The 2001 and 2003 tax cuts and AMT relief are by far the largest tax provisions set to expire before 2018, but about 80 smaller provisions are set to expire as well. Many of these provisions are commonly referred to as tax "extenders," because they are routinely extended by Congress each time they are slated to expire. The provisions include the research and experimentation tax credit, the state and local sales tax deduction, and numerous others. Some of these provisions existed before 2001, but the large majority of them have been added since.

According to the Congressional Budget Office and the Joint Committee on Taxation, making all of these provisions permanent would cost about $400 billion between 2009 and 2018, or about $500 billion if interest costs are included. Thus, the cost of extending all expiring tax provisions, including the 2001 and 2003 tax cuts, AMT relief, and the "extenders" would total $4.1 trillion over the 2009 to 2018 period, or $4.9 trillion including interest.

Every recession in modern U.S. history has been followed by an economic expansion, regardless of whether taxes were cut, increased (as in the early 1990s), or left unchanged. The recent tax cuts were no more responsible for the fact that the economy recovered from the recession that occurred in 2001 than the tax increases of 1990 and 1993 were responsible for the fact that the economy recovered from the downturn of the early 1990s, instead of remaining permanently stagnant.

Moreover, compared with other post-World War II recoveries, the recovery that began in 2001 is well below average. If tax cuts are crucial to economic growth, then that recovery should stand out brightly in comparison to previous recoveries. It should certainly outshine the comparable years of the 1990s recovery, during which taxes were increased. Instead, with respect to overall economic growth, as well as growth in consumption, investment, wages and salaries, and employment, the expansion that began in 2001 is either the weakest or among the weakest since World War II. Investment, wage and salary, and employment growth also have been significantly weaker than during the 1990s. (These comparisons held true even before the slowdown of the past few quarters began. [3])

Further, as discussed above, making the tax cuts permanent without paying for them would dramatically increase deficits and debt in future decades. A number of studies by highly respected institutions and economists have found that, if major tax cuts are deficit-financed, the negative effects of higher long-term deficits are likely to cancel out or outweigh any positive economic effects that might otherwise have resulted from the tax cuts.[4] All else being equal, large deficits lower national savings and thereby lower future national income. For instance, a comprehensive study of the 2001 and 2003 tax cuts by Brookings Institution economist William Gale and then-Brookings Institution economist (now CBO director) Peter Orszag found that making the tax cuts permanent without offsetting their cost would be "likely to reduce, not increase, national income in the long term."[5] The bottom line is that large deficit-financed tax cuts are as, or more, likely to reduce investment and economic growth as to increase them.

In an analysis of the long-run budget situation, the Congressional Budget Office commented that the economic benefits associated with maintaining lower marginal tax rates "are small compared with the economic benefits of moving the budget onto a sustainable track."[6] By doubling the size of the fiscal problem through 2050, extending the tax cuts without paying for them would make this far more difficult to do. It would be imprudent not only in light of the effects on the federal budget but also in light of the likely effect on the U.S. economy.

WASHINGTON, Jan. 7 ?- Families earning more than $1 million a year saw their federal tax rates drop more sharply than any group in the country as a result of President Bush's tax cuts, according to a new Congressional study.

The study, by the nonpartisan Congressional Budget Office, also shows that tax rates for middle-income earners edged up in 2004, the most recent year for which data was available, while rates for people at the very top continued to decline.

Based on an exhaustive analysis of tax records and census data, the study reinforced the sense that while Mr. Bush's tax cuts reduced rates for people at every income level, they offered the biggest benefits by far to people at the very top ?- especially the top 1 percent of income earners.

Though tax cuts for the rich were bigger than those for other groups, the wealthiest families paid a bigger share of total taxes. That is because their incomes have climbed far more rapidly, and the gap between rich and poor has widened in the last several years.

The study offers ammunition to supporters and opponents of Mr. Bush's tax cuts, which are all but certain to touch off a battle between the president and the Democrats who just took control of Congress.

WASHINGTON (April 2) - For the first time, Federal Reserve Chairman Ben Bernanke acknowledged the U.S. could reel into recession from the powerful punches of housing, credit and financial crises. Yet, he was coy about the Fed's next move.

The final and best means of strengthening demand among consumers and business is to reduce the burden on private income and the deterrents to private initiative which are imposed by our present tax system - and this administration pledged itself last summer to an across-the-board, top-to-bottom cut in personal and corporate income taxes to be enacted and become effective in 1963.

I'm not talking about a "quickie" or a temporary tax cut, which would be more appropriate if a recession were imminent. Nor am I talking about giving the economy a mere shot in the arm, to ease some temporary complaint. I am talking about the accumulated evidence of the last five years that our present tax system, developed as it was, in good part, during World War II to restrain growth, exerts too heavy a drag on growth in peace time; that it siphons out of the private economy too large a share of personal and business purchasing power; that it reduces the financial incenitives [sic] for personal effort, investment, and risk-taking. In short, to increase demand and lift the economy, the federal government's most useful role is not to rush into a program of excessive increases in public expenditures, but to expand the incentives and opportunities for private expenditures.

MCCAIN: "Shouldn't we give relief to average citizens who also are double taxed every single day?"

HOST KATIE COURIC: "But, Sen. McCain, if you listen to Commerce Secretary Don Evans, and he just appeared on this program, working Americans, the middle-class Americans, under the Bush proposals will get a major break. A family of four making $39,000 a year, according to Mr. Evans, will get a $1,100 tax cut for several years, allowing them to plan their individual budgets. That sounds like something that won't just simply benefit the wealthy."

MCCAIN: "Well, I think it will. But when you look at the percentage of the tax cuts that-as the previous tax cuts�-that go to the wealthiest Americans, you will find that the bulk of it, again, goes to wealthiest Americans. A lot of Americans now are paying a very large a�-low and middle-income Americans are paying a significantly larger amount of their income in taxes. I'd like to see them get the bulk of the relief."

�-NBC's "Today," Jan. 7, 2003.

I could care less who the conservative VP pick is which is why I didn't comment on it.

Also I am not opposed to tax cuts altogether just the current unfair tax cuts which have only benefited the wealthiest in the country while doing nothing for the middle class. (evidence of the truthfullness of that statement has been left.)

McCain used to agree before he disagreed.

Quote:MCCAIN: "Shouldn't we give relief to average citizens who also are double taxed every single day?"

HOST KATIE COURIC: "But, Sen. McCain, if you listen to Commerce Secretary Don Evans, and he just appeared on this program, working Americans, the middle-class Americans, under the Bush proposals will get a major break. A family of four making $39,000 a year, according to Mr. Evans, will get a $1,100 tax cut for several years, allowing them to plan their individual budgets. That sounds like something that won't just simply benefit the wealthy."

MCCAIN: "Well, I think it will. But when you look at the percentage of the tax cuts that-as the previous tax cuts�-that go to the wealthiest Americans, you will find that the bulk of it, again, goes to wealthiest Americans. A lot of Americans now are paying a very large a�-low and middle-income Americans are paying a significantly larger amount of their income in taxes. I'd like to see them get the bulk of the relief."

�-NBC's "Today," Jan. 7, 2003.

http://www.humanevents.com/article.php?id=24421

The fact is that we tried you all's way and this is the result; a dismal economy and soring deficits. When the middle class has to pay more in taxes relative to their incomes than do the wealthiest it is unfair and obviously does not spur the economy as we haven't really had a robust overall economy since Bush took office. We always recovering or reclining. But now McCain has obviously caved and if he wins we can look forward to more of the same.

Listen I am tired of going round and round on various subjects with you; you are rude for one thing and for another we are simply too different to make it worthwhile to sustain any conversation. On any given subject we are going to see it the opposite way, you think you are right and I think I am right, we both might be wrong; but in the end; I am sick of it. So I'll leave this thread in peace as it has become beyond tiresome.