@spendius,

You really don't understand politics, do you? Thought so all along, but now you have proved yourself as "ignorant." Throw them all out? LOL

@Advocate,

Advocate, one of your favorite issues, illegals, Obama may give them tax rebates.

"Lou Dobbs alert: Illegal immigrants may get rebates"

http://www.politico.com/blogs/thecrypt/0108/Lou_Dobbs_alert_Illegal_immigrants_may_get_rebates.html

@spendius,

spendius wrote:

Throw them out then. Marginalise them. Liquidate them. Let's try communism instead of piss-balling around on the edges.

I notice the Marxists are not hiding as much lately, many are more openly suggesting capitalism is dead.

Quote:Look at this equal pay for women malarkey your hero has signed today.

There's not a capitalist in the country who wouldn't pay women twice as much as men if they outperformed them enough. The guy's ridiculous. He'll do anything for a round of applause.

This is totally predictable for a bunch of lawyers, spendius. This is standard procedure for lawyers that have infested Washington D.C.

@cicerone imposter,

Quote:You really don't understand politics, do you? Thought so all along, but now you have proved yourself as "ignorant." Throw them all out? LOL

Your usual trick. You've been claiming I know nothing about evolution for years as well.

I can run rings around you ci. on both subjects and a few others as well. Not that that is saying much.

How does it happen that a few Reps have a lock on the budget when the majority of Califs. are "sick and tired" of them?

You get your sound bites out of Media and from people with an interest.

I notice your failure to comment on my pointing out the Americans are to blame for the crisis. They voted for it. I notice you have nothing to say on the repeal in 1999 of the Glass Seagall Act. Is that because the Dems did it?

And what's the use of giving women equal pay if your competitors don't follow suit? I bet Mrs Obama nagged him into that thinking that all occupations are of the talk/talk type.

And why no comment on my saying that every capitalist employer would pay women twice as much as men if they justified it on performance?

Blurts that I'm ignorant and don't know anything about politics are not worth a blow on a ragman's trumpet. And everybody, except you, knows it.

@spendius,

spendi wrote:

Quote:Your usual trick. You've been claiming I know nothing about evolution for years as well.

That's a far gone conclusion for most of us on a2k. Only you don't recognize it.

The Dems are not installing socialism. They do not propose state ownership of business -- far from it. They have put forward something really special to get people back to work. Indeed, it may not work. However, the best economic brains say this is the best approach. The Rep approach is basically the big lie, putting forward something that has been proven wrong a number of times.

ECONOMY

The Return To Bushonomics

Yesterday, in a 244-to-188 vote, the House approved an $819 billion economic recovery plan written by House Democrats and supported by President Obama. Despite Obama's aggressive outreach efforts, the entire Republican caucus, along with 11 Democrats, voted against the plan. Afraid of crossing Obama's high approval ratings, conservatives are claiming that they are enthusiastic to work with him. "We've made it clear that we will continue to work with the president to develop a plan that will work," said House Minority Leader John Boehner (R-OH), who led his caucus in opposition to Obama's plan. "We just don't think it's going to work." Instead, Boehner and his colleagues pushed for a return to Bushonomics. "We have said let's do tax cuts, let's let the American people make the decisions on how they'll spend the money," said Rep. Spencer Bachus (R-AL), on CNBC earlier this week."That will stimulate the economy more than bringing all that money to Washington and then distributing it out in all sorts of government programs." The alternative proposed by House Republicans yesterday, which was defeated 266-170, was composed almost entirely of tax cuts. "These are the same people who told us the Bush tax cuts were going to lead to nirvana," said Rep. Earl Blumenauer (D-OR) in response to the conservative focus on tax cuts. On MSNBC yesterday, one of the most prominent proponents of the tax-cut-only approach, Rep. Mike Pence (R-IN), complained that the Democrats' recovery plan would take "America in a new direction." Though conservatives might be happy to be free from the "burden" of President Bush, they still seem to be longing for his failed economic policies.

SAME OLD ARGUMENTS: In 2001 and 2003, Bush pushed massive tax cuts through Congress, claiming that they were "vital" to boosting the economy and creating jobs. Though Bush initially sold his 2001 tax cut by insisting "that the federal government was running an excessive budget surplus," he quickly changed his argument as the economy worsened, claiming they would be "a form of demand-side economic stimulus." "The economy has slowed down, in which case we need to accelerate tax cuts," Bush said in a March 2001 radio address. "You see, tax relief will put money in people's pockets, which will help give the economy a second wind." "By ensuring that Americans have more to spend, to save and to invest, this legislation is adding fuel to an economic recovery," announced Bush in 2003, as he signed his tax cut legislation. "We have taken aggressive action to strengthen the foundation of our economy so that every American who wants to work will be able to find a job."

BUSH'S TAX CUTS DIDN'T WORK: Before he left office this past month, Bush told he U.S. Hispanic Chamber of Commerce that "when people take a look back at this moment in our economic history, they'll recognize tax cuts work." But the fact is that they didn't. As Center for American Progress Senior Fellows Christian Weller and John Halpin noted in 2006, the outcome of the 2001 tax cuts was "the weakest employment growth in decades." The 2003 tax cuts didn't fare much better, resulting in job creation that was "well below historical averages." When Bush's White House proposed the 2003 cuts, they promised that it would add 5.5 million new jobs between June 2003 and the end of 2004. But "by the end of 2004, there were only 2.6 million more jobs than in June 2003." As Paul Krugman has pointed out, the belief that Bush's tax cuts successfully stimulated the economy is a form of mythology. CAP's Michael Ettlinger and John Irons wrote in September, "Economic growth as measured by real U.S. gross domestic product was stronger following the tax increases of 1993 than in the two supply-side eras" that followed Reagan's 1981 tax cuts and Bush's 2001 tax cuts. Indeed, employment growth was much stronger post-1993 than post-2001. The average annual employment growth was 2.5 percent after 1993 and just 0.6 percent after 2001. Unfortunately, the supply-side myth that tax cuts cure all still lives on today, as conservatives complain about progressive approaches to fixing the mess left by Bush.

TAX CUTS ARE INEFFECTIVE STIMULUS: The underlying folly of the conservative push for an all-tax cuts approach is the simple fact that tax cuts are ineffective stimulus. Mark Zandi, a former adviser to Sen. John McCain's (R-AZ) presidential campaign and the chief economist of Moody’s Economy.com, has argued for months that the "fiscal bang for the buck" of tax cuts is significantly inferior to spending increases. According to Zandi's research, a corporate tax cut delivers $0.30 in real GDP growth for every $1 invested. In comparison, infrastructure spending delivers $1.59 in GDP for every $1 spent. Zandi isn't alone in this belief: the Congressional Budget Office "deemed last year that corporate tax cuts are 'not a particularly cost-effective method of stimulating business spending.'" Despite these economic facts, conservatives like Sen. John Ensign (R-NV) continue promoting corporate tax cuts as the solution. "If we could lower the corporate tax rate, that would be one of the best things that we could do to make American business more competitive in the world and actually help stimulate the economy," Ensign claimed this week.

--americanprogressaction.org

@Advocate,

Not just "a number of times," but during almost every presidency headed by a republican.

They've been printing money like crazy lately!

@cicerone imposter,

For the upcoming inflation, what are the best places to be invested, ci?

@okie,

okie, We're not going to be seeing inflation any time soon. Try to guess why?

@cicerone imposter,

Do you actually read articles on economic matters written by people called Jeannine ci.?

Good grief!! Get a grip man.

@okie,

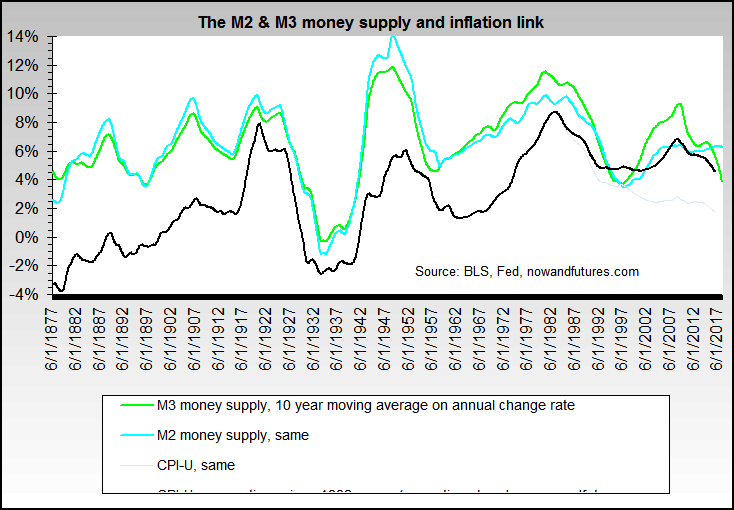

Printing money would normally mean an inflationary environment based on the multiplier effect of additional cash in the economy.

However, the money supply/inflation connection chart you posted doesn't take into account the loss of capital in the economy due to ponzi schemes like Madoff's, loss of home equity values, bank mortgage losses due to home foreclosures, Lehman bankruptcy capital obliteration(equity and debt instruments), individual investor portfolio losses(401ks, loss of 401k matching, personal investment portfolios et al), pension fund losses that must have their shortfalls made up or reduce pension benefits, etc, etc

These are just a few examples where there will be no multiplier effect on those evaporated assets, so government funds are barely offsetting that lost capital.

A good indicator of what the market watches for inflation is the 30yr treasury yield... currently at 3.59%. That's not much inflation expectation over the next 30 years.

@BigTexN,

So the drastic increase in money supply now is only taking up the slack that was created by a false inflation of all of those things that essentially amounted to wealth on the books that did not exist in reality, leading up to this point, such as home equity, etc.? By inflating the money supply now, it is an attempt to restore value to stuff that did not have that value, but banks and other people investing in them thought they did? So, we are bailing out the irresponsibility of people with the money saved and earned by responsible people, is that what it amounts to? Am I close or not?

@okie,

okie, You didn't listen to BTN's explanations very well, did you? Inflating the money supply now is not to re-inflate assets; it's to get the economy moving again. We're now in deflation, because of BTN's explanations. People continue to lose their jobs and homes, because most consumers are not spending money that makes up some 75% of our economy. This trend is here to stay for a very long time, because whatever government does will have a delaying effect on job creation and its intended effect to create more jobs. When a workers earns $50,000, he's going to spend a good portion of it just to live. If he has any money left over, he can opt to save some for retirement or buy some "luxury." Some will be able to do both, but that scenario for the majority is a long-term one when our unemployment has been decreased to almost 4% (considered by economists as full employment). And that's if we ever reach that point; the world economic competitiveness will be somewhat of a handicap for the American worker.

Comprende?

@okie,

Show us where the pork in the stimulus package will cost more than both wars?

@spendius,

spendi, That the government has to enforce an "equal pay" amendment just shows how backwards we have been as a country in seeking "equality" for every one.

"All men are created equal...." except for bigots.

@okie,

Okie, with regards to home equity, should the bank that holds my mortgage be required to market-to-market the value of that mortgage to 60% of its value even though I have never missed a payment, the mortgage is less than the current value of my house and I pay my mortgage via automatic withdrawal from my checking?

The common sense answer is "No". But, banks are being forced to show this on their books. The government loaned the banks funds to cover this shortfall related to an irrational, emotional pricing model.

The bank is not feeding those government funds back into the economy for 2 important reasons: 1) they need it to support the short-term mark-to-market anomaly on their books and 2) if they DID use the funds to free up credit, any new loan they underwrote would instantly be repriced on their books to less than its real value because of mark-to-market accounting.

Because the banks "borrowed" these funds and therefore must repay these loans, is it true that the governments printing of these funds created a multiplier effect and, by extension, inflation?